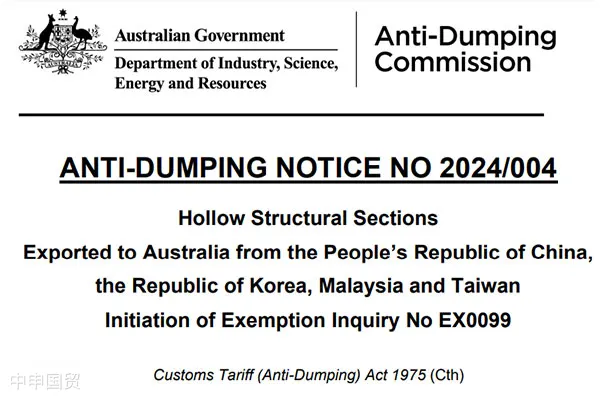

Differential duties refer to the situation where the same imported goods are levied different tax rates according to the actual situation or the exporting country.

This article deeply analyzes the transaction method of the customs declaration form and its relationship with the export invoice, provides practical operation suggestions for enterprises, and helps readers better understand and operate the customs declaration form and the transaction method.

PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912