- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

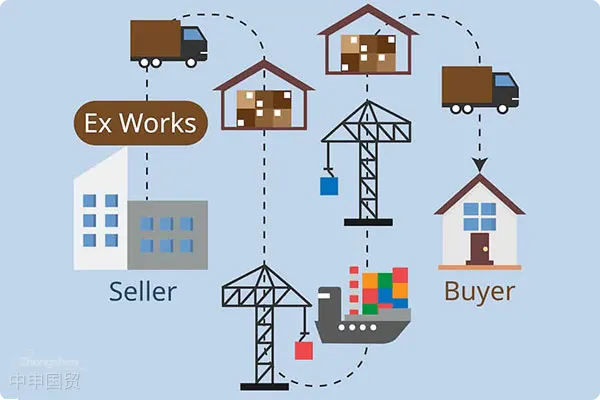

In international trade,EXW (Ex Works)is a very common trade term. According to the EXW terms, the seller only needs to deliver the goods to the buyer at its location (such as a factory or warehouse), and all subsequent costs and risks are borne by the buyer. However, in actual operations, there may beEXW (without incidental expenses)andEXW (with incidental expenses)situations. These two forms have obvious differences in the filling of customs declaration forms and customs valuation. This article will deeply analyze the operation methods of these two types of EXW and their differences in customs operations.

Definitions of EXW (without incidental expenses) and EXW (with incidental expenses)

A. EXW (without incidental expenses)

- Definition: The seller only delivers the goods to the buyer at its location and does not assume any other costs and responsibilities.

- Cost Bearing: The seller does not bear any incidental expenses, such asExport Clearancefees, loading fees, inland transportation fees, etc. All these expenses are borne by the buyer themselves.

B. EXW (with incidental expenses)

- Definition: Although the EXW term is adopted, the seller pays some incidental expenses on behalf of the buyer, such as export customs declaration fees, loading fees, inland transportation fees, etc.

- Cost Bearing: These incidental expenses are advanced by the seller and are usually reflected in the price of the goods. Eventually, they are paid by the buyer.

Differences in Customs Declaration Forms

A. Declared Price and Expenses

- EXW (without incidental expenses)

- Declared Price: Only includes the ex - factory price of the goods and does not include any incidental expenses.

- Filling of Customs Declaration Form: On the customs declaration form, the transaction method is filled in as EXW, and the declared value of the goods is the ex - factory price.

- EXW (with incidental expenses)

- Declared Price: Includes the sum of the ex - factory price of the goods and the incidental expenses advanced by the seller.

- Filling of Customs Declaration Form: On the customs declaration form, the transaction method is still filled in as EXW, but the specific amount of incidental expenses needs to be indicated in the Incidental Expenses column, and the declared value of the goods is the total price (ex - factory price + incidental expenses).

B. Customs Dutiable Value

- EXW (without incidental expenses)

- Dutiable Value: The customs usually takes the declared ex - factory price as the dutiable value.

- Impact on Taxes: Due to the relatively low dutiable value, the tax base for tariffs and value - added taxes is also relatively low.

- EXW (with incidental expenses)

- Dutiable Value: The customs will take the declared total price (including incidental expenses) as the dutiable value.

- Impact on Taxes: The dutiable value increases, and the tax base for tariffs and value - added taxes also increases accordingly.

C. Differences in Declaration Elements

- EXW (without incidental expenses)

- Transaction Method: EXW

- Freight, Insurance Premium, Incidental Expenses: Usually filled as 0 or left blank

- Value of Goods: Only the ex - factory price of the goods

- EXW (with incidental expenses)

- Transaction Method: EXW

- Freight, Insurance Premium, Incidental Expenses: Fill in the specific amount in the Miscellaneous Fees column

- Value of Goods: The sum of the ex - factory price and miscellaneous fees

Customs Valuation and Tax Calculation

A. Customs Valuation Principles

According to the Measures for the Customs of the Peoples Republic of China to Determine the Dutiable Value of Goods, the customs shall determine the dutiable value based on the transaction value. The transaction value shall include the price of the goods and all expenses directly or indirectly paid by the buyer to obtain the goods.import and export: Only the ex - factory price of the goods.

B. Differences in Tax Calculation

- EXW (without incidental expenses)

- Dutiable ValueTariffs, VAT

- : Calculated based on a lower dutiable value, the taxes and fees are relatively low.: Ex - factory price + Miscellaneous fees.

- EXW (with incidental expenses)

- Dutiable Value: Calculated based on a higher dutiable value, the taxes and fees increase.

- : Calculated based on a lower dutiable value, the taxes and fees are relatively low.If declared under EXW (without miscellaneous fees), but in the actual transaction, the seller advances the miscellaneous fees and fails to declare them in the customs declaration form, the customs may consider the declared price too low, suspecting under - reporting of the price, and may thus require the payment of additional taxes or conduct a price investigation.

C. Possible Adjustments by the Customs

Clarify Expenses

Practical Operational Suggestions

A. Declare Truthfully

- : Clarify the bearer and amount of each expense in the trade contract.Consistent Declaration

- : The declared price on the customs declaration form should be consistent with the total amount actually paid, including the price of the goods and the miscellaneous fees advanced by the seller.Expense Vouchers

B. Provide Supporting Documents

- : Keep and provide relevant invoices, receipts, contracts and other supporting materials for customs inspection.Contract Explanation

- : List the composition of expenses in detail in the trade contract, especially the miscellaneous fees advanced by the seller.Avoid Under - reporting

C. Avoid Risks

- : Prevent customs doubts caused by too low declared prices and avoid risks such as additional tax payments and fines.Professional Consultation

- : If you have any questions, consult a professional customs broker or customs department in a timely manner to ensure the accuracy and compliance of the declaration.In international trade, there are some differences in the operation details of customs declaration and customs valuation under the EXW term, especially in two cases. In actual operation, it is necessary to declare truthfully, clarify the bearer of each expense, and provide relevant supporting materials to avoid unnecessary risks and troubles. Through professional operations and rigorous contract terms, you can more effectively ensure the compliance and smoothness of trade.

Summary

Impact of Customs Commodity Code Adjustment on Export Enterprises and Handling Methods EXW (without incidental expenses) and EXW (with incidental expenses) Requirements for the Declaration Time Limit of Import and Export Goods and Handling of Special Circumstances

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912