- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

Relevant Introduction

Doforeign tradePeople often hear two professional terms: document customs declaration and purchase declaration. Lets take a look at the two customs declaration methods you need to know in trade.

What are document customs declaration and purchase declaration?

What are documents and bills

Document customs declaration refers to havingimport and exportEnterprises with import-export rights declare customs through documentation. This means the company provides its own export documents and handles customs clearance independently online or through an authorized agent, which constitutes normal customs declaration. The opposite approach is purchasing export documents for customs declaration. Companies without import-export rights or those unwilling to use their own company for export often encounter this issue. Export requires export documents. These companies typically purchase export documents from firms with import-export rights and submit them to freight forwarders. In other words, they export under another companys name. Of course, this method is not standard customs procedure.

Differences between document customs declaration and purchase declaration

Differences.

The main difference between document-based customs declaration and invoice-based declaration is that document-based declaration is legal while invoice-based declaration is illegal. Exporting companies must possess self-operated import-export rights. To encourage domestic enterprises to earn foreign exchange through exports, the government implements tax reduction policies for export companies. This preferential system naturally cannot be arbitrarily enjoyed by any company.

Advantages and disadvantages of purchase declaration

Advantages and disadvantages

Of course, not all enterprises currently possess import-export rights, so some still choose to purchase export documents for customs clearance.

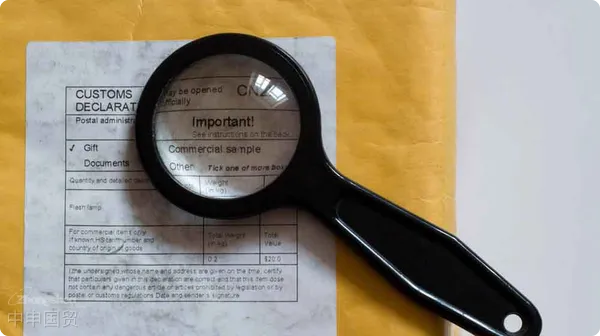

Advantages: 1. Convenient and hassle-free. Only need to provideMaritime Transportationthe required packing list, invoice, and bill of lading, without handling post-clearance verification matters personally. Ensures customer information security. Foreign trade companies generally worry about competitors poaching their clients. With purchased export documents, this concern disappears. Since companies selling verification documents never engage in foreign trade, theres no competition or risk of client theft.

Disadvantages: Cannot apply for tax rebates or enjoy national preferential policies, as exports are under another companys name, making tax rebates impossible. Also unsuitable for long-term cooperative clients, mostly suitable for one-time transactions.

Typically, users of purchased export documents are enterprises or individuals exporting low-value or infrequent shipments that dont require tax rebates. For those regularly engaged in import-export business, besides establishing their own import-export departments, they usually seek authorized foreign trade agency companies.

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912