- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

In international trade, the MRN number and HS code are two frequently occurring concepts, but the differences between them often cause confusion. Today, we will analyze them in detail. MRN (Movement Reference Number for Goods Transportation) and HS Code (Harmonized System Code) These two concepts will help you better understand their roles inimport and exportdeclaration.

What is MRN?

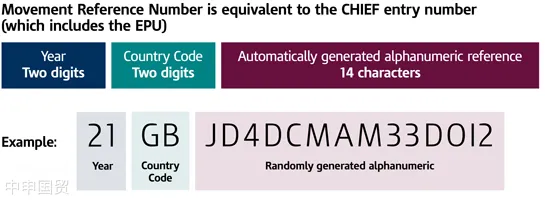

MRN (Movement Reference Number) is a unique number generated by the EU customs system, used to identify and track the transportation of import and export declarations or transit goods.

- Definition: The MRN is a unique number automatically generated by the EU customs system after the declaration is submitted.

- Purpose:

- Track Declaration and Goods Status: After the MRN is generated, both the declarant and the customs can track the progress of the declaration and the transportation status of the goods through it.

- Simplify Customs Procedures: The MRN helps simplify and accelerate the customs processing procedures, improve customs clearance efficiency, and facilitate the sharing and querying of relevant information.

What is HS Code?

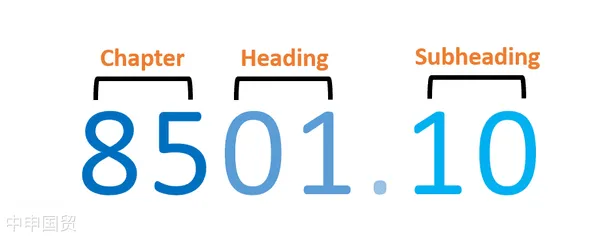

HS Code (Harmonized System Code) is an internationally unified commodity classification system formulated by the World Customs Organization (WCO), used to classify and identify goods globally.

- Definition: The HS code is an internationally common commodity classification system, uniformly used by customs of various countries.

- Purpose:

- Determine Tariffs and Taxes: The HS code is used to determine the applicable tariff rates and other related fees for goods.

- Comply with Regulations and Restrictions: Through the HS code, it can be identified whether certain goods are affected by import restrictions, quotas, or special regulatory measures.

- Trade Statistics: Governments and trade institutions of various countries use HS codes to statistically analyze import and export data.

Differences Between MRN and HS Codes

Different Natures:

- MRN: A unique number generated by the customs system for tracking declarations and goods.

- HS code: A commodity classification code provided by the declarant according to the characteristics of the goods.

Different Functions:

- MRN: Used to track and manage the customs declaration and goods transportation process.

- HS code: Used to determine the tariffs, taxes, regulatory requirements, etc. of goods.

Different Acquisition Methods:

- MRN: Automatically generated and allocated by the customs system after submitting the customs declaration.

- HS code: Determined by the declarant or customs broker according to the attributes and characteristics of the goods, and filled in the declaration form in accordance with the Harmonized System.

Application of MRN and HS Code in Customs Declaration

In the customs declaration process, MRN and HS code each play an important role, as follows:

- Determine the HS Code of Goods: The declarant needs to search for and confirm the correct HS code according to the specific situation of the goods. An accurate HS code helps to correctly determine tariffs and taxes and avoid problems during customs review.

- Fill in the Customs Declaration Form: Fill in relevant information such as the HS code, quantity, and value of the goods on the declaration form.

- Submit the Customs Declaration: Submit the declaration documents to the customs through an electronic system (such as the EUs ATLAS system).

- Obtain the MRN number: After the declaration is submitted, the customs system will generate an MRN as an identifier for tracking the declaration and the transportation status of the goods.

Example:

Suppose you want to export a batch of mechanical equipment:

- Determine the HS Code: Determine the HS code of the equipment according to its type and function, for example, 8483.30 (plain bearings).

- Fill in the Declaration Form: Fill in information such as the HS code, quantity, and value of the goods on the declaration form.

- Submit the Declaration: Submit the declaration documents through an electronic system.

- Obtain the MRN: The customs system will generate an MRN, and you can use this number to query the declaration progress and the transportation status of the goods.

Summary

MRN number is not HS code, they are two completely different concepts:

- MRN It is the unique number generated by the customs system after declaration for tracking and managing the transportation of goods.

- HS code It is the code provided by the declarant for classifying goods and determining the tariff rate.

During the customs declaration process, the declarant needs to first provide the correct HS code. After submitting the declaration, the customs system will generate an MRN number for subsequent tracking and management.

Understanding the difference between MRN and HS codes can help import and export enterprises better complete declaration and customs clearance, ensuring the smooth arrival of goods at their destination. Hope this article is helpful to you!

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912