- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

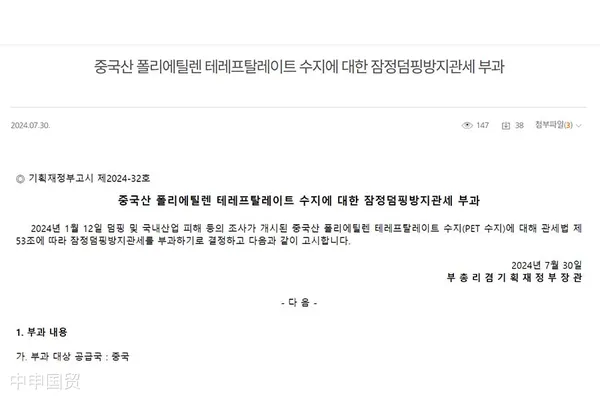

On July 30, 2024, the Ministry of Economy and Finance of South Korea issued Announcement No. 2024 - 32, deciding to impose a four - month temporary anti - dumping duty on PET resin (Polyethylene Terephthalate Resin) originating from China. This measure came into effect on the date of announcement and is valid until November 29, 2024. The Korean tariff number of the涉案 products is 3907.61.0000.

This counter - vailing investigation was announced by the US Department of Commerce on January 19, 2024. The investigation was directed at glass wine bottles imported from China, and at the same time, anti - dumping investigations were also launched on glass wine bottles from Chile and Mexico. The products involved are classified under the US customs code 7010.90.5019.

This anti - dumping investigation was launched by the Korea Trade Commission on January 12, 2024, targeting PET resin products originating from China. The investigation aims to determine whether Chinese exporters sell these products to South Korea at a price lower than the normal market value, thus causing unfair competitive pressure on the South Korean domestic industry. On May 30, 2024, the Korea Trade Commission made an affirmative preliminary ruling in this case and recommended that the Ministry of Economy and Finance of South Korea impose a temporary anti - dumping duty on the涉案 enterprises.

Temporary Anti - dumping Duty Rate

According to the announcement, the specific tax rates for South Korea to impose a temporary anti - dumping duty on PET resin originating from China are as follows:

| Serial Number | Colombia | Temporary Anti - dumping Duty |

|---|---|---|

| 1 | Hainan Yisheng Petrochemical Co., Ltd. Yisheng Dahua Petrochemical Co., Ltd. Hainan Yisheng Trading Co., Ltd. Hainan Hengrong Trading Co., Ltd. | 6.62% |

| 2 | China Resource Chemical Innovative Materials Co., Ltd. Zhuhai China Resource Chemical Innovative Materials Co., Ltd. China Resources Chemicals New Material Company Limited | 7.83% |

| 3 | Others | 7.12% |

Products Involved and Customs Codes

The PET resin products involved in this preliminary ruling are widely used in various fields such as packaging, fibers, and plastic bottles. The products under investigation are classified under the South Korean customs code 3907.61.0000.

Impact of the Temporary Measures

The imposition of the provisional anti - dumping duty aims to provide a fair competitive environment for South Korean domestic PET resin producers and prevent market distortion caused by low - priced imported products. The following are the possible impacts on different stakeholders:

- South Korean domestic producers:The provisional anti - dumping duty will provide short - term protection for local producers, enabling them to compete more effectively and maintain their market share.

- Chinese exporters:They will face an additional tax burden, which will increase the selling price of their products in the South Korean market and may lead to a decline in their market competitiveness.

- South Korean importers:They may need to pay higher prices, which may result in a reduction in import volume and a tightening of market supply.

- Consumers:The price of the final product may increase, affecting consumer spending.

Future Steps

During the validity period of the provisional anti - dumping duty, the South Korean Trade Commission will continue to conduct in - depth investigations to determine whether long - term anti - dumping measures need to be imposed on the products under investigation. It is expected that in the next few months, further data and evidence will be evaluated, and a final ruling will be made based on this.

Original text:Imposition of Provisional Anti - Dumping Duty on Chinese - made Polyethylene Terephthalate Resin

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912